In the world of high-risk payment processing, where regulatory pressure, chargebacks, and traffic volatility are constant threats, merchants need more than just a standard PSP. They need flexibility, control, and speed — and that’s exactly what a white label payment gateway provides.

This article explains what a white label payment gateway is, how it compares to traditional SaaS payment solutions, and why it’s become a go-to PSP solution for high-risk industries like iGaming, crypto, dating, Forex, and nutraceuticals.

What Is a White Label Payment Gateway?

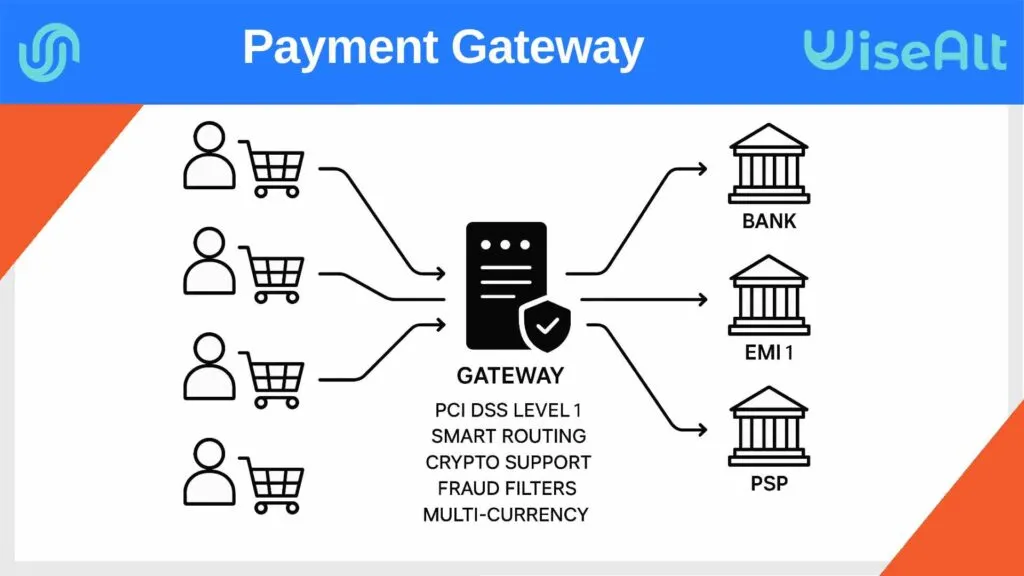

A white label payment gateway is a fully functional, rebrandable payment processing platform that you can operate under your own brand, without building it from scratch. It includes:

- A secure, PCI DSS-certified gateway core

- Admin and merchant back offices

- Hosted payment pages and APIs

- Pre-built connectors to 100+ payment providers

- Fraud protection, routing logic, and analytics tools

Unlike SaaS gateways like Stripe or PayPal, white label gateways are self-managed or agent-managed, giving you full control over integrations, rules, UI, and risk handling.

Why High-Risk Businesses Can’t Rely on Standard PSPs

Traditional PSPs often refuse or limit onboarding for industries classified as “high-risk” — including:

- Online gambling and betting

- Forex and trading platforms

- Crypto exchanges and wallets

- Adult entertainment and dating

- Travel aggregators and ticketing sites

- Supplement and nutraceutical businesses

These industries deal with higher chargeback rates, compliance complexity, or reputational risk. For them, a plug-and-play SaaS solution is often inaccessible or unreliable.

A white label PSP solution allows high-risk operators to integrate with multiple providers, set routing logic, and manage risk according to their traffic — all with a single integration and no dependency on external branding.

How a White Label Gateway Works

Once you license or rent a white label gateway:

- You get access to a branded payment platform hosted in a secure cloud (usually AWS or similar).

- You can connect to 300+ payment methods — cards, e-wallets, crypto, mobile, bank wires.

- Smart routing logic lets you cascade transactions, handle PSP failover, and optimize approval rates.

- A built-in fraud management system helps mitigate risk per GEO, amount, and behavior.

- Both merchant and admin portals provide full control over payments, users, limits, and reporting.

Most importantly — everything is customizable: payment pages, rules, integrations, reports, and branding.

Key Benefits for High-Risk Merchants

✅ Full Control

Decide how to route, who to work with, and what rules to apply.

✅ Better Approval Rates

Use smart routing and cascading to avoid declines from single PSPs.

✅ Customization

Control the UI, branding, and payment flow — even build custom modules.

✅ Compliance & Stability

Hosted on PCI DSS Level 1 infrastructure with secure backups and logs.

✅ Multi-GEO Flexibility

Accept payments globally — cards in the EU, crypto in Asia, mobile money in Africa — through one unified system.

SaaS vs White Label: What’s the Difference?

| Feature | SaaS Gateway | White Label Gateway |

|---|---|---|

| Branding | Provider’s branding | Fully your brand |

| Provider Choice | Fixed | You choose + integrate |

| High-Risk Support | Limited / denied | Full support |

| Smart Routing / Cascading | No | Yes |

| PSP Failover Handling | No | Yes |

| Merchant Control | Minimal | Full |

| Custom Development | No | Yes |

| Monthly Fee | None or minimal | From €500 / merchant |

| Use Case | Low-risk SaaS | Medium/High-risk B2B |

Who Should Use a White Label PSP Solution?

If you’re in a high-risk vertical, plan to process large volumes, or want to manage multiple merchants — this is for you.

It’s especially relevant if you:

- Have limited onboarding options at traditional PSPs

- Want to improve approval rates across GEOs

- Need better fraud control or data transparency

- Intend to offer PSP services to third-party merchants

Final Thoughts

For high-risk businesses, a white label payment gateway is more than a technical tool — it’s a strategic infrastructure investment.

It allows you to route payments smarter, onboard merchants faster, and reduce dependency on third-party processors. Whether you’re launching a new PSP brand or want more control over your payment stack — this model delivers unmatched flexibility and resilience.