TL;DR

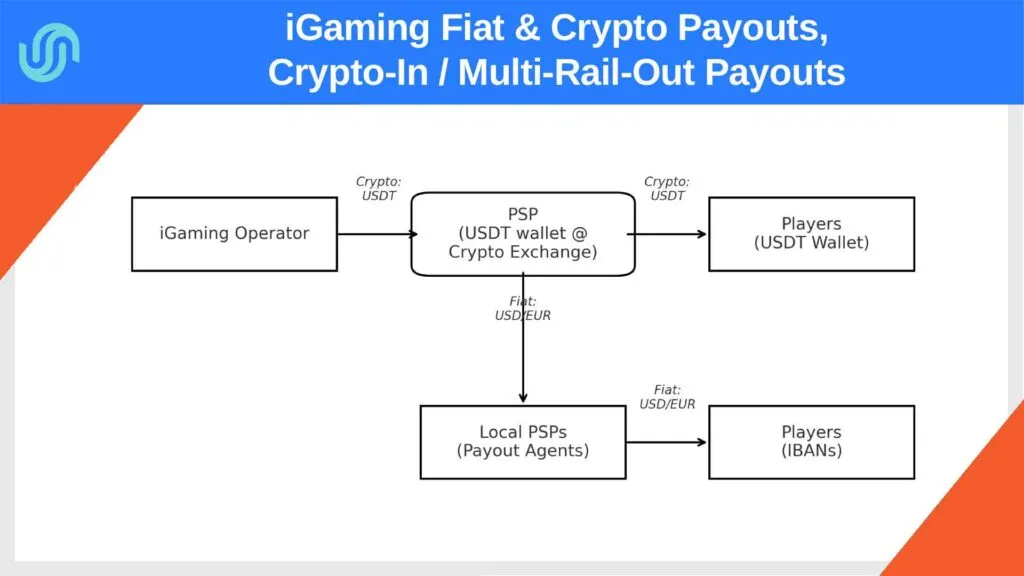

Players want fast withdrawals and choice. Thus iGaming projects need to make payouts to their players in Crypto (mainly stablecoins) and Fiat (Euro, USD, etc.) The most efficient pattern for payments for iGaming especially for fiat & crypto payouts is crypto-in / multi-rail-out: fund in USDT, then pay out in USDT on-chain or fiat via SEPA/SWIFT or push-to-card through licensed partners.

Why iGaming payouts are hard

- Multi-geo bases; players expect crypto, local betting payment methods, bank, or instant card pushes.

- Heavy AML/sanctions, KYT for iGaming, and Travel Rule requirements.

- Card-only refunds increase disputes and scheme friction.

- Weeks lost testing vendors that won’t underwrite iGaming.

Target architecture

- Payment System (licensed PSP) — executes payouts & reporting.

- Crypto Exchange/Custody (VASP) — holds USDT, address screening, on-chain sends.

- Bank/EMI hub — EUR/USD liquidity, off-ramp, SEPA/SWIFT.

- Payout aggregator — Visa Direct/Mastercard Send + local rails via one API.

- KYT + Travel Rule — on-chain risk and VASP↔VASP data exchange.

But good news – all this could be realized through one strategic PSP partner who already has all these elements.

High-level flow of iGaming Fiat & Crypto Payouts

- Merchant funds USDT → dedicated address at a VASP.

- Compliance gate → KYT; Travel Rule when thresholds apply.

- Withdrawal request: method (USDT/SEPA/SWIFT/card), country, KYC tier, amount.

- Routing & FX:

- USDT→USDT on-chain (TRC20/ERC20/Polygon).

- USDT→Fiat off-ramp → SEPA/SWIFT or push-to-card.

- Statuses & reconciliation via webhooks + daily files.

Compliance playbook (iGaming specifics)

- Operator KYB: license/authorization, geo policy, responsible gaming.

- Player KYC tiers: T1 micro, T2 PoA/biometric, T3 SoF/SoW.

- KYT on all crypto legs; block mixers/sanctions.

- Travel Rule for VASP↔VASP above thresholds.

- Geo/sanctions controls (EU/UK/US lists).

- Fraud rules: duplicate IBAN/BIN, velocity, looped flows.

WiseAlt prepares a prescreen dossier so vendors can underwrite faster.

Integration checklist

API (payouts.create/quote/confirm/track), IBAN/BIC & BIN validation, on-chain checksum + memo/tag prompts, standardized webhooks & reason codes, daily reconciliation, cut-offs, crypto batching.

FAQ (iGaming Fiat & Crypto Payouts)

Can we (iGaming merchants) skip banks? Yes for crypto-only withdrawals. For fiat, use a Bank/MSB/EMI hub and often a payout aggregator.

TRC20 or ERC20? TRC20 cheaper/faster; ERC20 broader exchange support. Publish per-network limits/fees for players.

How to reduce disputes? Offer crypto & SEPA; use push-to-card where supported; keep card-refunds for edge cases.

CTA

Disclaimer (B2B, vendor-neutral): WiseAlt is an introducer and consultant only. We do not provide regulated payment services, do not process or hold client funds, and are not a PSP/EMI/bank/VASP or an introducing broker. Any payment/crypto/off-ramp/banking/card services are delivered exclusively by duly licensed third-party providers selected by the merchant; availability, pricing, limits, and timelines depend on local laws, sanctions, and provider underwriting. Nothing here is legal, tax, or investment advice, nor an offer to consumers or a promotion of gambling/CFD trading. Merchants remain responsible for their own licensing, AML/CFT & sanctions compliance (including KYC/KYB/KYT/Travel Rule) and, where applicable, client-money segregation.