Telegram payments are becoming a critical growth driver for iGaming merchants. With over 900 million monthly users worldwide [Statista], Telegram has evolved from a simple messenger into a powerful ecosystem for commerce, payments, and even regulated industries like iGaming. Recently, a European iGaming merchant approached WiseAlt with a challenge. Their project was running entirely in Telegram, generating more than €300,000 per month in deposits, but payments for iGaming acceptance was unstable.

This is their story — and how we helped transform their payment flow.

The Challenge: Processing iGaming Transactions in Telegram

The merchant already had a license, which allowed them to legally operate their iGaming business. But licensing alone doesn’t guarantee smooth payment processing.

The biggest obstacles were:

- Unstable local methods — existing regional APMs could not keep up with the volume.

- High decline rates — card transactions saw frequent rejections from issuers due to iGaming being a high-risk vertical.

- Fraud exposure — Telegram payments are vulnerable to fraud attempts, bot traffic, and stolen card testing.

- Chargebacks — even legitimate players sometimes disputed transactions, pushing chargeback ratios to dangerous levels.

At the same time, official Telegram Payment API options (such as Stripe, LiqPay, YooKassa) are limited to low-risk merchants. For high-risk industries like iGaming, they simply don’t approve the accounts.

The merchant needed a scalable, compliant, and multi-method payment strategy inside Telegram.

Why Most Payment Providers Refuse Telegram iGaming Projects

From our experience, only a handful of payment providers are ready to onboard a Telegram-based iGaming project. The reasons are clear:

- Anonymity of the channel – Telegram allows rapid user acquisition, but with limited KYC enforcement at the front end.

- High chargeback ratios – iGaming averages between 1–3% monthly chargebacks, above what most acquirers tolerate.

- Fraud vectors – account takeovers, promo abuse, and card testing are common.

- Regulatory risk – acquirers fear non-compliance with AML and gambling regulations.

As a result, mainstream providers such as Stripe or Adyen simply decline such merchants, leaving them with crypto or offshore alternatives.

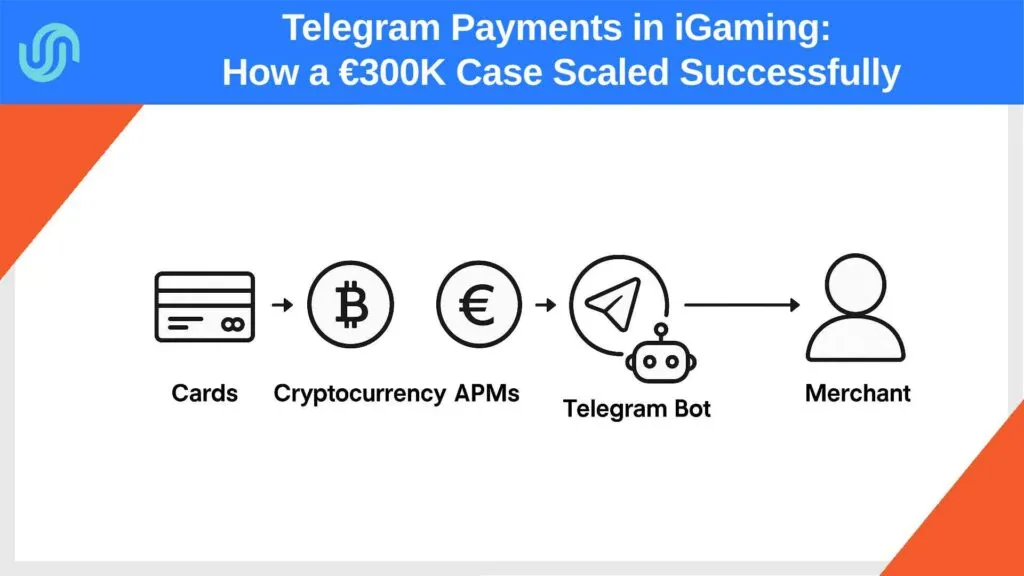

Our Approach: Building a Payment Stack for Telegram

WiseAlt designed a multi-layered solution:

- Offshore merchant account for cards

Allowed stable Visa/Mastercard deposits, with fraud filters tuned specifically for iGaming. - Crypto payment integration

Support for USDT, BTC, ETH directly in Telegram via a custom payment bot.

Players preferred this for privacy and speed. - Alternative payment methods (APMs)

SEPA transfers for European players and local e-wallets for specific regions. - Fraud & risk management

- Device fingerprinting

- Velocity checks

- Escrow model for large deposits (>€500)

- Telegram bot integration

We built a seamless flow so that users never had to leave Telegram to deposit.

The Results After 3 Months

The impact was immediate:

- Approval rates improved from below 60% to more than 80% on card payments.

- Chargeback ratio dropped from dangerous levels to less then 1% of monthly volume.

- Crypto payments adoption grew from a marginal method to 35% of all deposits, reducing operational risk.

- Overall volume increased by 30%, reaching nearly €400,000 per month.

What began as a fragile payment setup turned into a reliable, scalable engine for growth.

Recommendations for iGaming Merchants in Telegram

From this case, several lessons are clear:

- Don’t rely on local methods only. They are often unstable at scale.

- Telegram Payment API is not suitable for high-risk. Providers like Stripe or LiqPay may approve only low-risk merchants.

- Diversify your stack:

- Crypto (USDT, BTC, ETH) for high acceptance.

- Offshore merchant accounts for cards.

- Local APMs (SEPA in Europe) to build trust with players.

- Risk management is essential. Without fraud prevention, chargebacks and compliance issues will kill profitability.

What About WhatsApp and Viber?

While Telegram leads the way for iGaming, other messengers have started offering payments — but they are far less suitable:

- WhatsApp Payments

Available in select countries, but designed for small merchants.

The whatsapp business payment option and whatsapp business payment feature are tightly restricted to low-risk verticals. - Viber Payments

Used in e-commerce in Eastern Europe, but rarely in high-risk industries.

Viber payments can support digital goods, yet lack the scale needed for iGaming.

In practice, 95% of high-risk messenger-based projects rely on Telegram payments.

The Bigger Picture

As Mastercard’s 2024 eCommerce fraud report notes, fraud is growing across all industries. High-risk sectors like iGaming face this challenge even more severely.

That is why choosing the right telegram payment providers — with a mix of crypto, cards, and local methods — is essential to scaling safely.

Conclusion: How WiseAlt Helps

At WiseAlt, we specialize in iGaming payment providers and high-risk industries. This case study shows how even a merchant with more than €300K monthly turnover in Telegram can struggle without the right setup. But with the right mix of telegram payment methods, compliance, and fraud prevention, growth is not only possible — it is sustainable.

If you are running an iGaming project in Telegram and need help setting up stable telegram payments, contact us today.