Cross-border declines US cards: causes, fixes, and routing that actually works

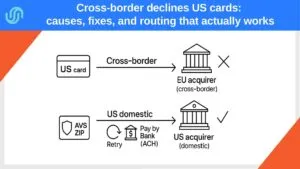

A European online project gets a rush of US buyers… and approvals sag, i.e. cross-border declines US cards: causes, fixes, and routing that actually works. That’s the classic cross-border decline pattern: the issuer sees “US cardholder → non-US merchant/acquirer,” becomes stricter, and says no. The cure isn’t one trick—it’s better data, smarter retry logic US issuers, and (when warranted) local routes or US-native rails.

Cross-border declines US cards: causes, fixes, and routing that actually works Read More »