Discover news & insights on technical integrations, payment methods and global compliance for high-risk industries like gambling, crypto, forex, nutra, tourism, gaming, and dating...

From API strategies and IBAN setups to acquiring routes and AML obligations — we cover what matters for modern payment teams.

Have a challenge worth discussing? Let’s talk.

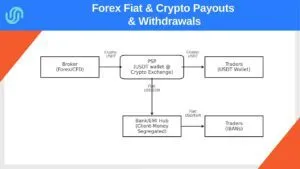

Forex Fiat & Crypto Payouts & Withdrawals — WiseAlt Guide

For CFD & Forex Fiat & Crypto Payouts, the same crypto-in / multi-rail-out model applies—fund in USDT, pay traders in…

Crypto Merchant Services: How to Select the Best Payment Provider

At WiseAlt, we’ve seen too many crypto businesses get burned by choosing the wrong crypto merchant services and payment provider….

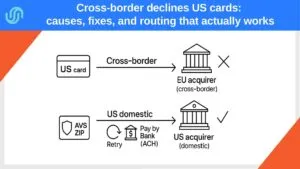

US domestic acquiring for EU merchant: how to fix US declines, choose solutions, and route like a local

TL;DR. If a European merchant pushes a lot of US-issued cards through an EU acquirer, the traffic looks cross-border to…

How to improve payments conversion rate

In the competitive e-commerce landscape, every step of the checkout process plays a crucial role in determining the conversion rate….

Global Expansion Strategies for Traveling: Leveraging Consultancy for Success

Introduction The travel and hospitality industry in the U.S. holds substantial growth potential, yet many companies are still not fully…

Crypto On-Ramps and Off-Ramps for High-Risk

Crypto on-ramps and crypto off-ramps serve as critical infrastructure for businesses operating in high-risk sectors like iGaming, crypto businesses, forex…

Cross-border declines US cards: causes, fixes, and routing that actually works

A European online project gets a rush of US buyers… and approvals sag, i.e. cross-border declines US cards: causes, fixes,…

Gateway Due Diligence Checklist for MSB/EMI/PSP Purchasing Deals

Fraud prevention high-risk is not only about tools—it’s about controllable processes: routing governance, logs, access roles, and incident-ready operations. When…

High-Risk Banking Accounts

Benefits of Additional Reserve Banking Accounts for High-Risk Businesses For high-risk businesses, maintaining additional or backup banking accounts or IBANs…

Payment Solutions for High-Risk Startups: Overcoming the First Time Deposit Barrier

Launching a new project in a high-risk vertical like iGaming, Forex, Crypto, or Dating can be exciting—but accessing reliable payment…

How iCasinos, Dating Sites, and Forex Reduce Transaction Verifications Using Crypto and eWallets Top-Ups

Industries such as online casinos, dating platforms, and Forex trading often face significant payment challenges. Banks and traditional payment processors…

What Is a Merchant Account and How to Choose the Right Payment Provider for Your Online Business

In today’s global e-commerce ecosystem, knowing what is a merchant account is no longer optional — it’s essential. Whether you’re…