In high-risk industries like iGaming, Forex, crypto, and adult services, payment approval rates can make or break your business. That’s why choosing the right smart payment routing logic for your PSP setup is critical.

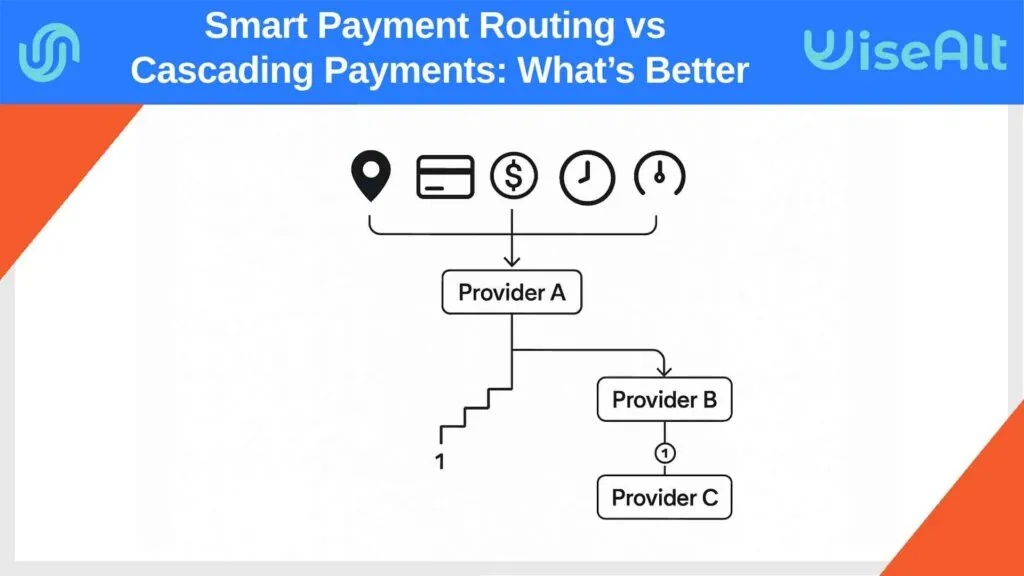

Two of the most powerful tools in modern payment infrastructure are smart payment routing and cascading payments. While they serve similar goals — maximizing transaction approval and minimizing declines — they function differently and are suited for different strategies.

In this guide, we’ll break down what each method does, how they compare, and how to combine them effectively for a robust, future-proof PSP orchestration setup.

What Is Smart Payment Routing?

Smart payment routing is a logic-based mechanism that selects the optimal payment provider in real time — before a transaction is initiated — based on dynamic conditions like:

- Customer location (GEO)

- Card BIN and issuer country

- Transaction amount and currency

- Time of day or day of week

- Risk score or past behavior

For example, a payment from Brazil using a local-issued card may be routed to a PSP with local acquiring, while a payment in crypto may be sent to a specialist exchange with low latency.

Smart routing uses data to determine which PSP is most likely to approve the transaction before it even hits the first endpoint.

What Are Cascading Payments?

Cascading payments are a fallback mechanism where, if a transaction fails with one provider, it’s automatically retried with the next provider in a predefined sequence — and so on, until it’s either approved or all options are exhausted.

It’s often used in scenarios like:

- Card declines due to issuer restrictions

- Temporary provider downtimes

- Volume or velocity caps on a specific PSP

- High-risk GEOs that produce inconsistent results

Unlike smart routing, cascading doesn’t pick the best PSP up front. It follows a chain of attempts to rescue the transaction post-failure.

Smart Routing vs Cascading: Head-to-Head

| Feature | Smart Routing | Cascading Payments |

|---|---|---|

| Trigger | Pre-transaction | Post-decline |

| Logic type | Dynamic / rule-based | Sequential fallback |

| Speed | One attempt only — faster | Multiple attempts — slower |

| Conversion impact | High if routing logic is optimized | High if fallback options are solid |

| Ideal for | Predictable, high-volume GEO flows | Unstable GEOs or volatile traffic |

| Setup complexity | Medium to high (needs data) | Medium (preset fallback chains) |

| Fraud risk management | Preventive | Reactive |

Why High-Risk Merchants Need Both

In high-risk verticals, no single PSP or routing method is enough. Combining smart routing with cascading delivers the best of both worlds:

- Smart routing ensures high-approval entry points based on real-time logic

- Cascading picks up failed transactions and attempts recovery

- You maintain control over traffic, can run A/B tests, and adjust rules by country, BIN, or merchant

By layering routing strategies, merchants can increase approval rates by 10–30%, reduce processing costs, and ensure continuity even during PSP outages.

Real-World Example

Let’s say your platform serves users from Brazil, Germany, and Nigeria. Your routing engine may do this:

- Route local cards to a domestic PSP with low FX fees

- Route SEPA payments to a pan-European acquirer

- Route mobile money via a regional APM provider

- And if any of those fail — cascade the transaction to your backup PSP list for that region

This logic can be managed via a modern PSP orchestration system that WiseAlt helps integrate for clients in high-risk sectors.

How WiseAlt Can Help with Smart Payment Routing

WiseAlt doesn’t develop payment technology in-house, but acts as a commercial and technical consultant for battle-tested, white-label payment orchestration platforms. These systems support both:

- Smart payment routing with rules, filters, and analytics

- Cascading payments with fallback logic and adaptive flows

Why our partner solution?

- ✅ Built specifically for high-risk verticals

- ✅ Offers more control and better pricing than major orchestration vendors

- ✅ Managed by a responsive team with high integration velocity

- ✅ PCI DSS Level 1, crypto-friendly, and multi-currency capable

We help you integrate it quickly and optimize it for your business model.

Further Reading:

- How Smart Payments Routing Can Stop False Declines

- Empowering merchants: 8 payment solutions for achieving higher acceptance rates

Final Thoughts

If your current PSP declines too many transactions or fails to handle regional traffic well — it’s time to rethink your routing logic.

Combining smart payment routing and cascading payments gives high-risk merchants the best shot at stability, control, and profitability.

Don’t let technical rigidity drain your margins. Build a payment infrastructure that adapts with every transaction.