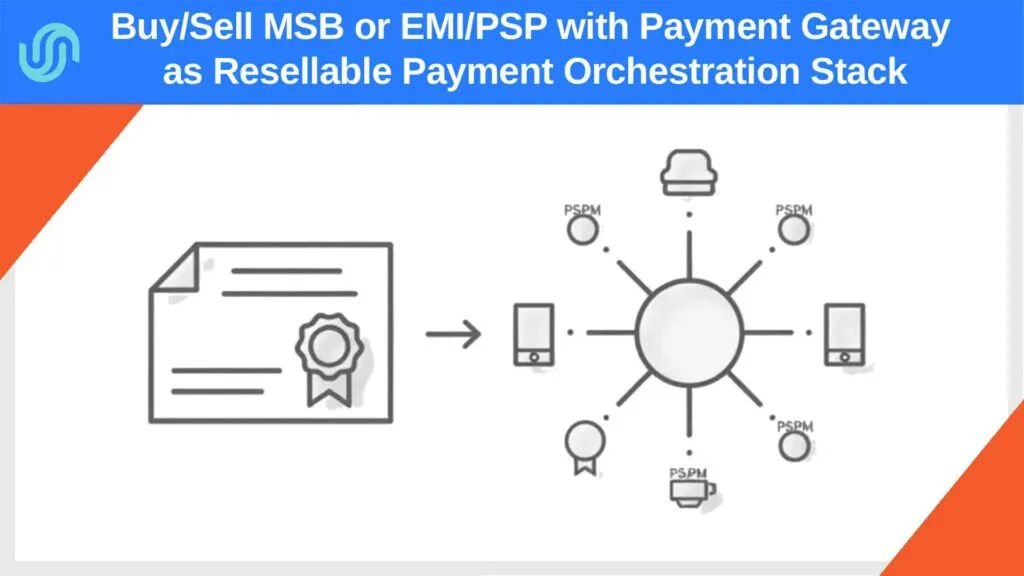

A payment gateway can turn an MSB or licensed EMI/PSP deal from a “license-only handover” into a scalable, resellable payments business. Buyers don’t just want a legal wrapper—they want a working operating engine: routing, cascading, reporting, logs, and a clear onboarding workflow that can survive audits and partner due diligence. This matters across three groups: (1) MSB/EMI sellers and resellers who want higher liquidity and valuation, (2) agents and ISOs moving beyond commission-only models into payment orchestration or Merchant of Record, and (3) enterprise iGaming operators or high-risk merchants managing many PSPs/APMs across multiple geographies. In short: the gateway is the product layer you can monetize, improve, and eventually sell as a complete business. So it make sense to buy/sell MSB (Canadian or US) along with Payment Gateway to capitalize the deal.

If you’re an iGaming here is an article about iGaming at scale: routing, cascading, and multi-PSP control with an orchestration layer.

The core idea: a license without a gateway is not a product

A license (MSB/EMI/PSP) is your regulatory perimeter — but the gateway is the commercial engine. A buyer can’t “operate” efficiently without orchestration logic, audit logs, reconciliation, and controlled access. In Canada, for example, MSBs must register and meet obligations as reporting entities—so buyers will ask for operational evidence, not just paperwork. Check FINTRAC MSB overview and registration guidance for details.

What changes when the gateway is part of the asset:

- You’re selling a working payments platform, not a “future rebuild.”

- You can monetize platform usage (internal/partner), not only deals.

- You can demonstrate auditability: logs, roles, documentation, and controls.

Who this is for

1) Sellers & resellers of MSB / EMI / PSP

You want buyers to see a deal they can launch fast—with predictable cost and reduced rebuild risk.

2) Agents/ISOs moving into orchestration or Merchant of Record

You want control over routing, approvals, and partner switching—without vendor lock-in.

3) Enterprise iGaming & High-risk merchants (multi-geo, many APMs/PSPs)

You need centralized governance, cascading, limits, reporting, and operational resilience at scale.

What buyers should evaluate (gateway decision criteria)

Must-have

- Ownership / transferability of IP and operational access

- Routing + cascading rules (by geo, currency, amount, risk, provider health)

- Logs and audit trail (who changed routing, when, and why)

- Reconciliation / reporting (transaction lifecycle visibility)

Should-have

- Merchant/partner portal and standardized onboarding

- Checkout flexibility (localized, configurable fields)

- Provider limits, auto on/off, monitoring hooks

Nice-to-have

- Smart retries, payment links, configurable idempotency, token logic (where applicable), existing integrations

Read how to prepare a deal kit for selling an MSB/EMI/PSP with a gateway and why a gateway matters if you want to move beyond referral-only revenue.

Deal structures

Option 1 — Buy/Sell MSB/EMI/PSP + gateway IP (full ownership)

Best for buyers who want a resellable platform asset and maximum control.

Option 2 — Buy/Sell MSB/EMI/PSP + gateway lease + buyout option

Best when the buyer wants a lower-risk start but needs a clear path to ownership.

Due diligence checklist (what to verify before signing)

Regulatory scope fit

In the UK, whether you fall inside the Payment Services Regulations is a perimeter question—buyers need clarity on activities and scope. See: FCA PERG 15 on payment services scope.

EU authorization expectations (PSD2)

For EU payment institutions/EMIs, authorization and registration expectations are shaped by PSD2 and EBA guidance. Check: EBA Guidelines on authorisation and registration under PSD2.

Security and card data scope

If the gateway touches card data, buyers must understand PCI DSS responsibilities and documentation. See: PCI SSC standards and PCI DSS resources.

Related guides

- Use this gateway due diligence checklist before signing any MSB/EMI/PSP deal.