Forex Fiat & Crypto Payouts & Withdrawals — WiseAlt Guide

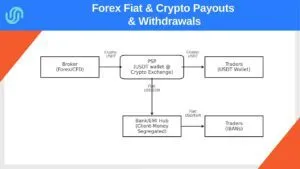

For CFD & Forex Fiat & Crypto Payouts, the same crypto-in / multi-rail-out model applies—fund in USDT, pay traders in USDT on-chain or fiat via SEPA/SWIFT/push-to-card—but you must respect client-money segregation. WiseAlt (no funds processing, no license) acts as a vendor-neutral introducer & consultant, shortlisting licensed providers and designing CASS/MiFID-friendly flows.

Forex Fiat & Crypto Payouts & Withdrawals — WiseAlt Guide Read More »