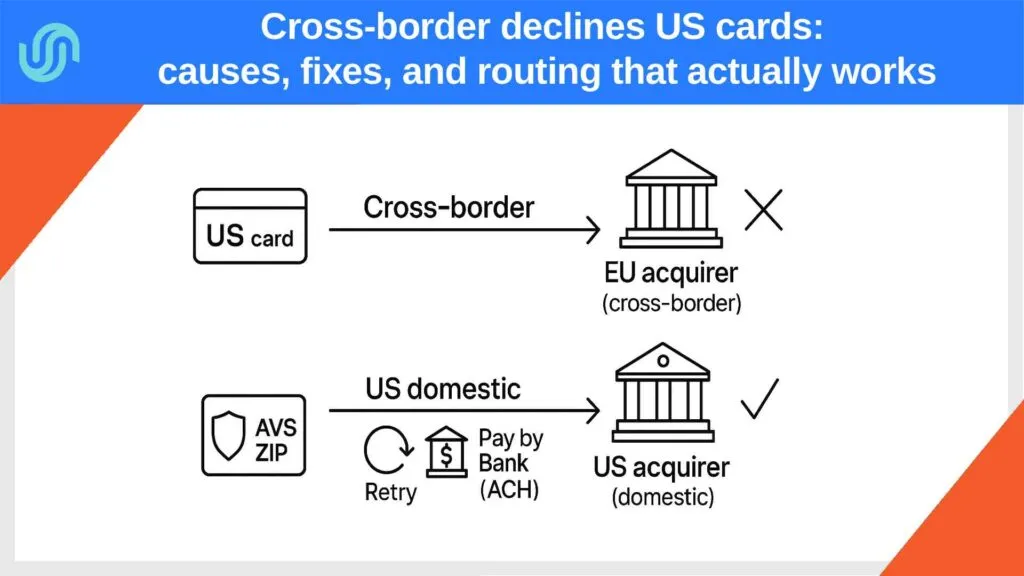

A European online project gets a rush of US buyers… and approvals sag, i.e. cross-border declines US cards: causes, fixes, and routing that actually works. That’s the classic cross-border decline pattern: the issuer sees “US cardholder → non-US merchant/acquirer,” becomes stricter, and says no. The cure isn’t one trick—it’s better data, smarter retry logic US issuers, and (when warranted) local routes or US-native rails.

Why US cards decline more cross-border

1) Country and data mismatches. When the cardholder is US but your merchant/acquirer location resolves to the EU, issuers are stricter. Processors consistently note that local acquiring tends to Improve US authorization rate because it aligns with issuer expectations.

2) Merchant-location disclosure gaps. Visa wants the true country/location shown to users and carried through auth, clearing, and chargebacks. Inconsistent location data adds friction and avoidable disputes.

3) AVS realities for US cards. US issuers lean on AVS (ZIP) for CNP risk checks. Cross-border flows often yield partial or “can’t verify” outcomes, which pushes more soft declines.

4) Generic issuer risk outcomes. Expect “do_not_honor” and similar decline codes more often on cross-border attempts; the fix is rarely one-size-fits-all.

Diagnose first: a compact playbook

- Classify refusals (soft vs hard) by network/processor decline codes and issuer country; track them by BIN to spot patterns.

- Check AVS/CVV distributions and map “U/partial” outcomes to your step-up/Retry plan.

- Run $0 account verification where appropriate to filter dead cards before auth.

Fixes that lift approvals (without copy-pasting your whole stack)

1) Clean up what issuers “see”

- Merchant location: make it consistent—in UI, in descriptors, and in message data—so the transaction looks coherent.

- Descriptor & support signals: a recognizable name and reachable contact reduce disputes that feed issuer models.

2) Tune authorization and retries

- AVS-aware decisions: approve, step-up (3-DS), or retry only when AVS/CVV suggests recoverability.

- Network tokens + Account Updater (VAU/ABU) cut passive churn (expired/lost cards) and reduce needless soft declines.

3) Route more intelligently (before going “domestic”)

- BIN routing USA: when an issuer is US, prefer routes that minimize cross-border penalties and data loss; local routes typically convert better.

- Discover acceptance online US & Amex coverage: if you sell to US consumers, ensure your gateway actually enables these schemes; support varies by region and affects approvals.

4) Offer a bank-based fallback at checkout

- Pay by Bank (Plaid) for subscriptions/invoices and bill-pay flows. (Plaid is an account-connection layer many gateways use to verify bank accounts and initiate ACH with strong user consent.)

When to consider US-domestic routing

If the majority of your US volume is cross-border and soft declines remain after hygiene/routing fixes, test a US MID with a reputable acquirer/PSP (or a US payment gateway for European company scenarios supported by global PSPs). Domestic routing often Improves US authorization rate and lowers total cost; it usually requires a US entity, US bank account, and TIN.

“Cross-border declines US Cards” toolkit (what to implement this week)

Data & UX

- Align merchant location everywhere (site copy, legal pages, descriptor, transaction data).

- Add $0 account verification before the first charge on higher-risk cohorts.

Auth controls

- Enforce AVS ZIP on US cards; trigger 3-DS step-up only when AVS/CVV suggests it will help.

- Turn on VAU/ABU to refresh stored credentials.

Routing & methods

- BIN routing USA; if your PSP exposes “local US rails” without a US entity, A/B-test before a full domestic setup.

- Add Pay by Bank (Plaid) as a labeled alternative at checkout for recurring and invoice-style payments.

Analysis

- Break out decline codes (network + processor) and monitor recovery after each change.

Who benefits most (including high-risk)

SaaS, marketplaces, cross-border e-commerce—and regulated/high-risk verticals—see outsized gains from these fixes. Position pages with phrases users actually search for: fraud prevention high-risk, high-risk e-commerce solutions, US payment gateway for European company, Improve US authorization rate, BIN routing USA, Discover acceptance online US, Pay by Bank (Plaid), and retry logic US issuers.

Metrics that prove the fix

- US authorization rate (by BIN / by route)

- Soft-decline recovery after AVS/3-DS and token/Updater changes

- Cost per successful order (cards vs Pay by Bank)

- Dispute rate / win rate after descriptor & policy clean-up

Sources & further reading (outbound)

- Visa Merchant Data Standards (merchant location), AVS codes, Payment Account Validation ($0 auth) — visa.com

- Adyen on local acquiring and cross-border acceptance

- Stripe guidance on decline codes and recoveries

- Nacha (ACH basics, Same Day ACH)

- The Clearing House RTP® overview

- Federal Reserve FedNow® service overview