TL;DR

Forex brokers need to make payouts to their traders in Crypto (USDT) and Fiat (Euro, USD, etc.) For CFD & Forex Fiat & Crypto Payouts, the crypto-in / multi-rail-out model applies—fund in USDT, pay traders in USDT on-chain or fiat via SEPA/SWIFT/push-to-card — but you (Forex broker) must respect client-money segregation. WiseAlt (no funds processing, no license) acts as a vendor-neutral introducer & consultant, shortlisting licensed providers and designing CASS/MiFID-friendly flows.

Why payouts are tricky in Forex/CFD

- Client money rules (segregation, daily reconciliation, no commingling).

- Multi-geo traders and IB/affiliate rebates with mass payouts.

- Tight AML/sanctions; KYT for crypto legs; SoF/SoW on large withdrawals.

- Card pushes not always underwritten for Forex; SEPA often cheaper for larger EU payouts.

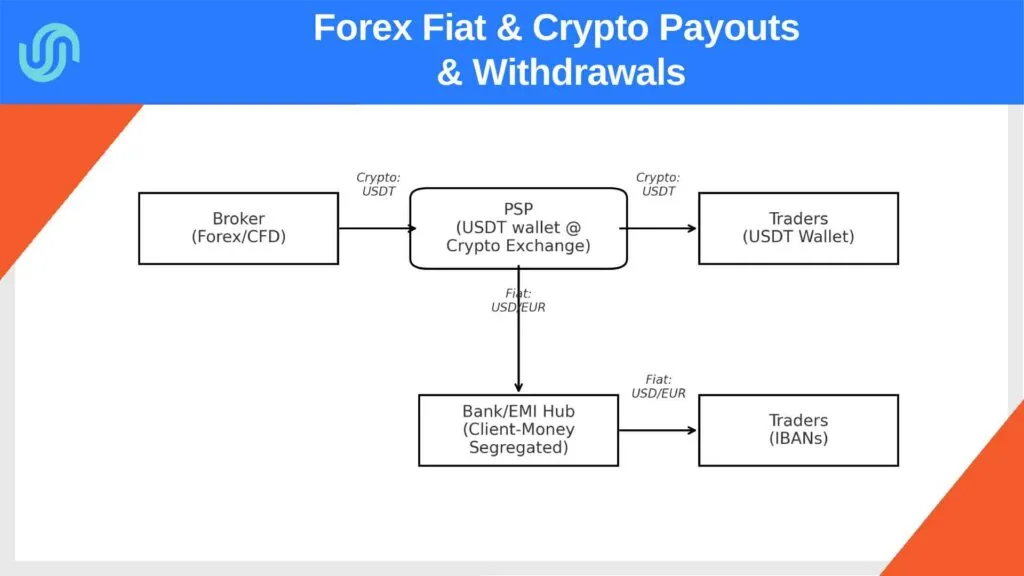

Target architecture (with client money in mind)

- Payment System (licensed PSP) — executes withdrawals & reporting.

- Crypto Exchange/Custody (VASP) — USDT custody, address screening, on-chain sends.

- Bank/EMI hub — segregated client-money accounts, off-ramp, SEPA/SWIFT.

- Payout aggregator (optional) — instant card & local rails.

- KYT + Travel Rule — crypto risk & VASP data exchange.

But good news – all this could be realized through one strategic PSP partner who already has all these elements.

High-level flow

- Broker funds USDT → VASP custody.

- Compliance gate → KYT; Travel Rule when needed.

- Withdrawal request (trader/IB): method (USDT/SEPA/SWIFT/card), country, KYC tier, amount.

- Routing & FX:

- USDT→USDT on-chain.

- USDT→Fiat off-ramp to EUR/USD → SEPA/SWIFT or push-to-card.

- Client-money reconciliation: separate ledgers/IBANs, daily files, audit trail.

Compliance playbook (Forex/CFD specifics)

- Licensing (MiFID/FCA/ASIC etc.), client-money segregation (CASS/MiFID) and statements.

- KYC tiers with SoF/SoW escalation on large withdrawals.

- KYT on inbound/outbound crypto; sanctions/mixer blocks.

- Geo restrictions and marketing rules for CFD (disclaimers, restricted jurisdictions).

- Mass payouts for IB/affiliates with corridor limits & batching.

Integration Checklist for Forex Fiat & Crypto Payouts

Unified API surface (payouts.create/quote/confirm/track), validations (IBAN/BIC/BIN), on-chain checksum + memo/tag, standardized webhooks & reason codes, segregated ledgers/IBANs, daily reconciliation, cut-offs & crypto batching.

FAQ (Forex/CFD)

How do we (Forex merchants) segregate client funds? Use dedicated client-money IBANs and separate ledgers; reconcile daily; keep ops funds separate.

Can we use push-to-card for traders? Sometimes; underwriting varies—keep SEPA/SWIFT ready as baseline.

Can we go crypto-only? Yes for withdrawals; verify wallet ownership at higher tiers and maintain KYT/Travel Rule routines.

CTA

Disclaimer (B2B, vendor-neutral): WiseAlt is an introducer and consultant only. We do not provide regulated payment services, do not process or hold client funds, and are not a PSP/EMI/bank/VASP or an introducing broker. Any payment/crypto/off-ramp/banking/card services are delivered exclusively by duly licensed third-party providers selected by the merchant; availability, pricing, limits, and timelines depend on local laws, sanctions, and provider underwriting. Nothing here is legal, tax, or investment advice, nor an offer to consumers or a promotion of gambling/CFD trading. Merchants remain responsible for their own licensing, AML/CFT & sanctions compliance (including KYC/KYB/KYT/Travel Rule) and, where applicable, client-money segregation.