Introduction Launching a new project in a high-risk vertical like iGaming, Forex, Crypto, or Dating can be exciting—but accessing reliable payment solutions for new high-risk startups is often the most frustrating roadblock. While mature businesses in these industries are courted by payment providers offering competitive fees, custom solutions, and VIP support, newcomers face the opposite: delays, rejections, and red tape.

In this article, we explore the challenges of payment system onboarding for new high-risk businesses, explain what FTD (First Time Deposit) means, and how expert consulting can bridge the gap between startups and the payment ecosystem.

What Is FTD and Why Does It Matter? FTD, or First Time Deposit, refers to the initial deposit a real end-user makes via a payment system on your platform. For example, when a new player registers at an online casino and makes their first deposit of €50, this counts as one FTD.

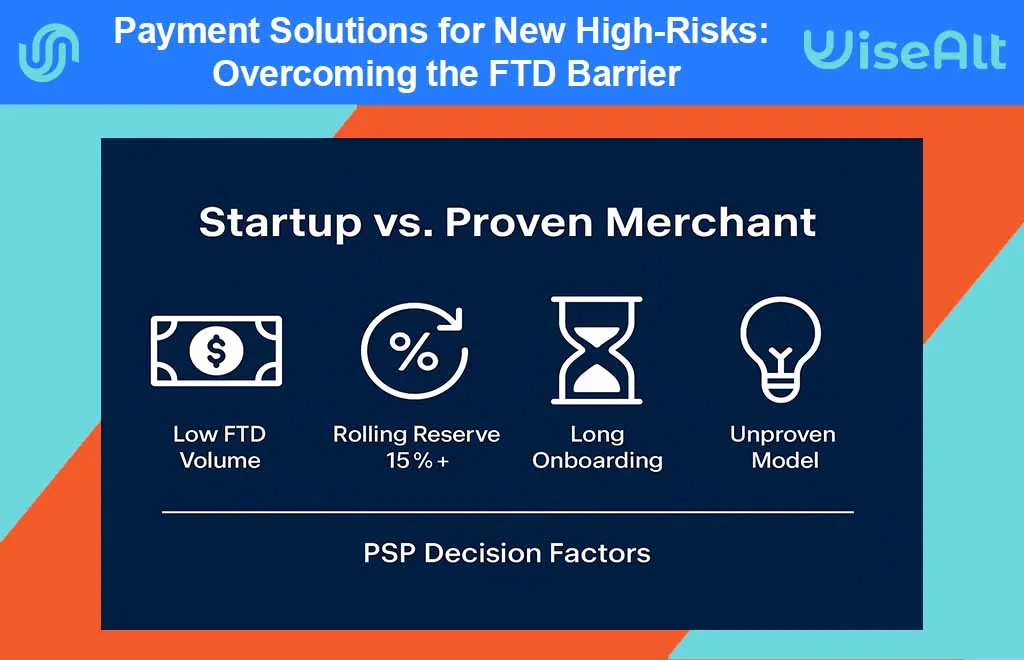

For payment service providers (PSPs), acquiring banks, and EMIs, FTDs are critical: they prove that the project can attract live traffic, convert users, and process legitimate transactions.

New merchants are often required to:

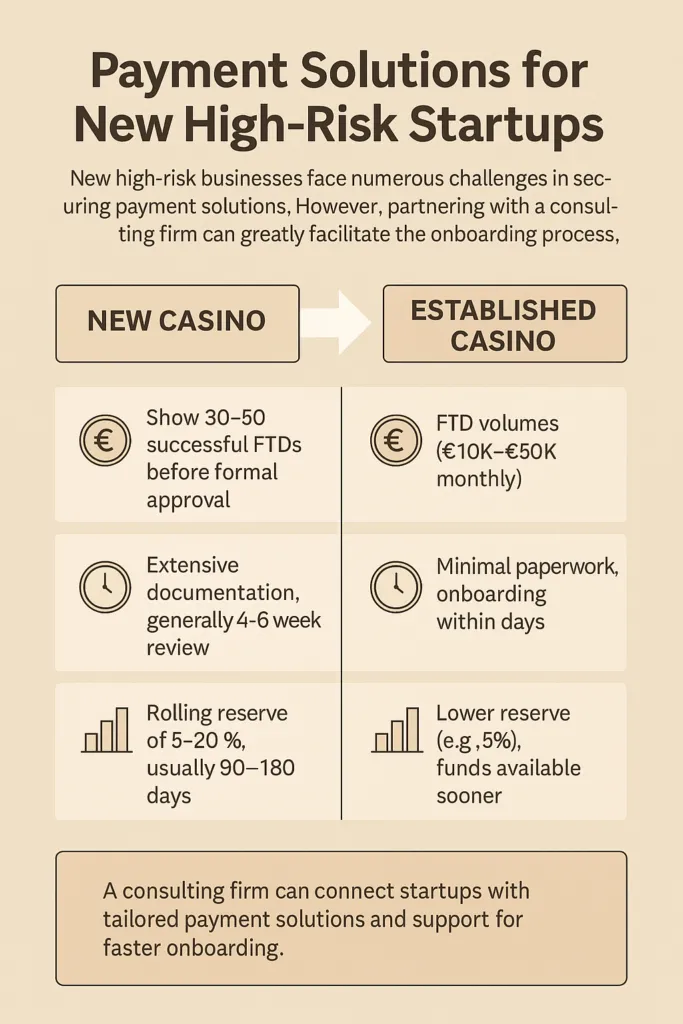

- Show 30–50 successful FTDs (i.e., 30–50 users who made real first-time payments) before formal approval of long-term merchant conditions

- Maintain average FTD values within industry norms (e.g., €20–€100 per user, depending on GEO and sector)

- Keep chargeback rates below critical thresholds

- Demonstrate geographical diversity of user deposits

Without stable FTD volumes (typically €10K–€50K total per month from new users), providers may:

- Reject merchant account applications

- Request financial guarantees or security deposits

- Impose unfavorable terms (e.g., 6–10% commissions, delayed settlements)

- Leave onboarding applications unanswered for weeks

Important note: These volumes are not your internal deposits or wallet top-ups, but real end-user payments processed through external PSPs.

Additionally, most PSPs working with high-risk merchants enforce a rolling reserve — a percentage (often 5–20%) of your processed volume that is held back temporarily (usually 90 to 180 days) to cover potential refunds, chargebacks, or fraud claims.

This means that even after you’re approved, you won’t receive 100% of your daily processed funds immediately — part of it will be held in reserve to protect the provider.

Example: Comparing a New Casino vs. Established Brand Imagine two online casinos applying to the same payment provider.

- Casino A is a new startup with no transaction history. Their website is live, but they haven’t processed any user payments. The PSP requests: legal structure docs, AML policy, details of traffic sources, and a rollout plan. They are asked to bring 50+ FTDs before approval. A 15% rolling reserve is proposed.

- Casino B has operated for 2 years, processes €300K/month, and has consistent traffic and low chargebacks. The PSP offers them immediate onboarding, 3.5% commission, next-day settlement, and no reserve.

Conclusion: Payment providers want to ensure that the time and operational costs spent on onboarding a merchant will be justified by real, sustainable volume. With a startup, this is uncertain — and risk-averse PSPs will delay or reject such applications unless supported by strong strategy and structure.

High-Risk Verticals: Who’s Affected? High-risk industries are flagged due to regulatory exposure, fraud potential, or elevated chargeback rates. These include:

- Casino / iGaming / Betting: Often require jurisdictional licenses, subject to intense scrutiny

- Forex / Trading / Financial Signals: Require specific merchant categorization and sometimes financial services licenses

- Crypto / Token Sales / P2P Platforms: Hybrid fiat-to-crypto solutions with global regulatory challenges

- Dating (Freemium & Subscription Models): Require recurring billing setups, age/identity verification, and chargeback mitigation

- Online Courses & Coaching with aggressive funnels: Content regulation, chargebacks, and marketing policy compliance.

Why Payment Systems Ignore Newcomers Payment systems are highly cautious when working with new high-risk projects. Here’s why:

- Lack of transaction history: No past data means high perceived risk

- Intensive documentation: PSPs request detailed KYC/AML policies, business models, traffic flow charts, and legal compliance proofs

- Technical complexity: Requirements include 3DSecure, payment gateway architecture, and legal separation between front-end and processing entities

- Skepticism toward the industry: Even clean projects are judged by the reputation of their niche

- Fragmented providers by region: For example, India needs UPI, Brazil uses PIX, and Africa prefers M-Pesa

Most importantly, a payment provider invests real time, operational effort, compliance review, and legal coordination to onboard a merchant — and with startups, the risk that this investment will not pay off is significantly higher. That’s why strong preparation and expert guidance are essential to overcoming this barrier and to get payment solutions for new high-risk startups.

How a Consultant Can Help Working with an experienced consulting firm can significantly simplify the onboarding process for new high-risk startups. Here’s how:

- Structured preparation: We help you design a compliant legal, technical, and operational setup from day one

- Tailored documentation: You’ll receive ready-made templates for KYC, AML, and legal disclosures adjusted to PSP expectations

- Provider matchmaking: We identify and introduce payment partners suited to your geography and risk profile

- Step-by-step onboarding: From first contact to approved merchant account, we manage communication, follow-ups, and negotiation

- Early FTD generation strategies: We help attract initial deposits via third-party processing or phased rollout plans.

Conclusion Launching a high-risk startup is hard enough—securing payment solutions for new high-risk startups shouldn’t make it harder. Whether you’re launching an iGaming platform, Forex brokerage, crypto service, or dating site, we can help you meet onboarding requirements, generate First Time Deposits, and connect with payment partners who understand your model.

Let us help you save months of trial and error, avoid unnecessary rejections, and start processing payments with confidence.

Need help launching your payment infrastructure? Let’s talk.